“RBI Stays Firm on Inflation Management and Economic Growth Strategy in MPC Meeting”

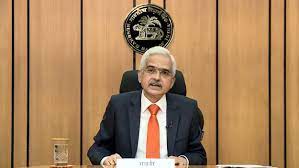

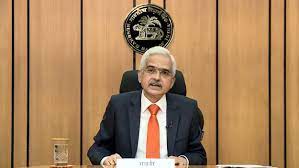

The recent Monetary Policy Committee (MPC) meeting of the Reserve Bank of India (RBI) has sparked discussions and speculations about the future trajectory of interest rates in the country. Governor Shaktikanta Das’ analogy likening inflation to an elephant going out for a walk has drawn attention to the possibility of a rate cut later in the year, despite the current policy rate remaining unchanged at 6.5%.

The recent Monetary Policy Committee (MPC) meeting of the Reserve Bank of India (RBI) has sparked discussions and speculations about the future trajectory of interest rates in the country. Governor Shaktikanta Das’ analogy likening inflation to an elephant going out for a walk has drawn attention to the possibility of a rate cut later in the year, despite the current policy rate remaining unchanged at 6.5%.

The MPC’s decision to maintain the policy rate at 6.5% since February 2023, after a series of rate hikes starting from May 2022, reflects the RBI’s focus on curbing inflation. The policy rate stood at 4% in April 2022, indicating a significant increase over time.

Governor Das’s statement after the MPC meeting highlighted the concern over inflation and the need for it to descend to the target of 4%. The statement also acknowledged the economy’s robust growth prospects, with the MPC retaining its projection of 7% GDP growth and 4.5% inflation for the fiscal year 2024-25.

One of the major concerns highlighted in the MPC statement is food prices, which continue to impact the inflation outlook. Despite expectations of a record harvest for the winter crop, food price uncertainties remain, especially due to climate shocks affecting food production. This uncertainty has made the MPC cautious about the inflation environment in the Indian economy.

Analysts believe that the RBI’s decision on interest rates is also influenced by external factors, such as potential interest rate cuts by the US Federal Reserve. The RBI’s emphasis on sustainable inflation reduction to 4% indicates a cautious approach towards monetary policy easing, with expectations of a rate cut in the third quarter of 2024.

The MPC’s focus on reassessing potential growth and real neutral rates after the release of 2023-24 GDP data in May reflects a data-driven approach towards monetary policy decisions. This assessment will play a crucial role in determining the future direction of interest rates and the overall economic outlook.

In conclusion, while the RBI has maintained a status quo on interest rates in the latest MPC meeting, the discussions and statements indicate a cautious approach towards balancing inflation concerns with economic growth prospects, setting the stage for potential future policy adjustments.

Sources By Agencies

You’re welcome! I appreciate your willingness to engage further. If you have any specific questions or topics you’d like to delve into, feel free to share them. Whether it’s about recent developments in technology, intriguing scientific discoveries, captivating literature, or anything else on your mind, I’m here to provide insights and assistance. Simply let me know how I can help, and I’ll be happy to assist you further!