The Retirement Crisis: Why India’s Youth May End Up Old and Broke

Hetal Upadhyay believes India is sleepwalking into a retirement crisis.

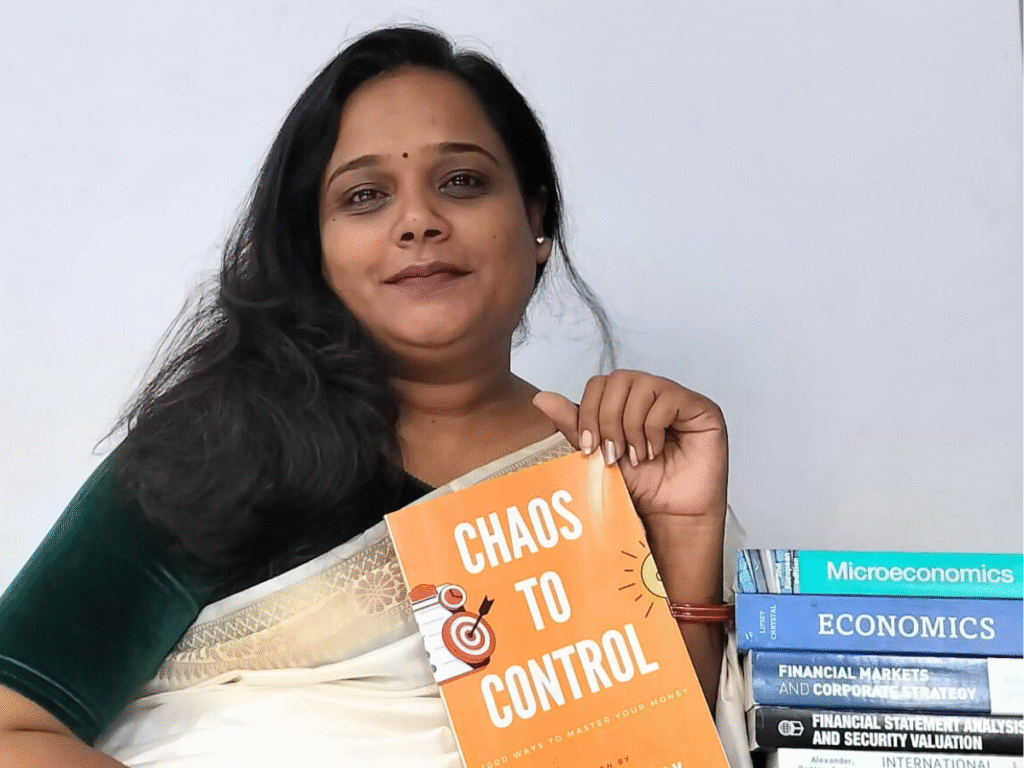

Author of the book Chaos to control-Hetal Upadhyay believes India is sleepwalking into a retirement crisis. While today’s youngsters are busy chasing careers, gadgets, and experiences, she says very few are thinking about a time when they will stop earning. “It sounds harsh, but if things don’t change, many of today’s youth will grow old and broke. And sadly, by the time they realize it, it will be too late,” she says.

Hetal explains that earlier generations had it easier. Government jobs came with pensions, and families often lived together, so there was always some financial support in old age. But things have changed. Most people now work in private companies, switch jobs often, or run their own businesses. That means no guaranteed pension, no safety net. “The truth is simple — if you don’t plan for your retirement, nobody else will,” she points out.

The bigger issue, according to her, is lifestyle. Young earners today upgrade their phones every year, travel frequently, and don’t think twice before dining out or shopping online. While enjoying money is not wrong, Hetal says the problem is ignoring savings completely in the process. “Your 20s and 30s are golden years for investing. Every rupee saved then has decades to grow. But once you lose those years, you can’t buy them back. That’s what most people don’t realize,” she explains.

Then there’s the growing love for credit. With instant loans, Buy Now Pay Later, and credit cards everywhere, borrowing has become the easiest thing in the world. But Hetal warns this is like stealing from your own future. “People in their 30s are already drowning in EMIs for things that don’t even hold value after a few years. If you’re paying for yesterday’s iPhone today, how will you build tomorrow’s retirement fund?” she asks.

The problem doesn’t stop there. Indians are living longer than before, but healthcare is getting more expensive every year. Inflation quietly eats away at whatever little savings people have. Hetal puts it bluntly: “The scary part about retirement is not just running out of money — it’s running out of money when you’re too old to earn it back.”

So what’s the way out? Hetal insists it’s not rocket science. Start early, start small, but start. A simple SIP in mutual funds, contributing to the National Pension System (NPS), or just putting aside 10–15% of your income regularly can make a huge difference. “Don’t wait to earn big money before you start. Even a small amount, invested consistently, can turn into a solid retirement corpus. The earlier you begin, the less you need to save later,” she explains.

She also suggests building the habit of increasing savings whenever income grows. Instead of using every salary hike for lifestyle upgrades, set aside a portion for your future self. “Think of it as paying your future rent in advance. Your 60-year-old self will thank you,” she adds with a smile.

But Hetal believes the problem can’t be solved only at an individual level. Companies should promote retirement savings, schools should teach financial basics, and regulators must crack down on predatory loans. “We can’t just leave people to figure it out on their own. If financial literacy becomes part of our education system, we can prevent a majority of these mistakes,” she says.

She ends on a note of urgency but also hope: “Retirement planning is not about age, it’s about mindset. If you start today, you can live with dignity and independence tomorrow. But if you ignore it, you might find yourself old, stressed, and dependent. The choice is in our hands — and the time to act is now.”